What is SupTech?

SupTech, short for supervisory technology, is the application of emerging technology to improve how supervisory agencies conduct supervision.

Regulatory technology — or, RegTech — is in the midst of a full-blown revolution, overhauling how financial service firms handle regulatory compliance.

Asset managers are automating laborious processes like disclosure production through robotic process automation. Wealth managers are streamlining the tiresome process of know-your-customer data collection and suitability analysis through compliance management solutions. And firms of all sizes and shapes are now able to automate the burdensome work of regulatory change management through AI-powered knowledge automation solutions.

In short, the industry is in the throes of digital disruption. The advances in technology that have upended so many other industries are doing the same to regulatory compliance. And, to date, financial institutions have been the ones to bear the benefit of this.

But that’s beginning to change.

The same technologies that have launched the RegTech industry over the last few years are now propelling a similar rise in a sector very, very closely related to RegTech.

SupTech, short for supervisory technology, is the use of those same breakthrough technologies but by supervisory agencies to help support supervision. In essence, it’s leveraging the technologies of RegTech for regulators themselves.

READ MORE: What is RegTech?

SupTech Solutions for a Data-Driven World

SupTech benefits from a serendipitous coincidence. Both the work of supervisory agencies and the technologies that are fueling our current technological revolution are underpinned by the same thing: data.

Data — and specifically the ability to aggregate and analyze large sets of it — is what has fueled the deep learning revolution of the last decade.

Neural networks can crunch the large data sets of online images to create image recognition software. Machine learning algorithms ingest massive troves of regulatory documents to create knowledge automation solutions. For industries built around big data, technology now offers a plethora of ways to reduce errors and improve efficiencies.

This perfectly coincides with the modern approach to financial regulation, which is built around big data. But today’s approach also manages data in a manual, time-intensive, and usually backward-looking manner.

Consider, for example, the lengthy onsite inspections regulators regularly conduct as a means of collecting data, and the cumbersome analysis process which, when it results in supervisory action, is often focused on incidents that happened months or even years ago.

SupTech offers that possibility to fundamentally change this.

Imagine a scenario where regulators receive data feeds directly from the firms they are regulating. Rather than having to go out and collect the data, the data is funneled into their systems — and is then analyzed by machine learning and natural language processing technologies in order to flag suspicious transactions or behaviors.

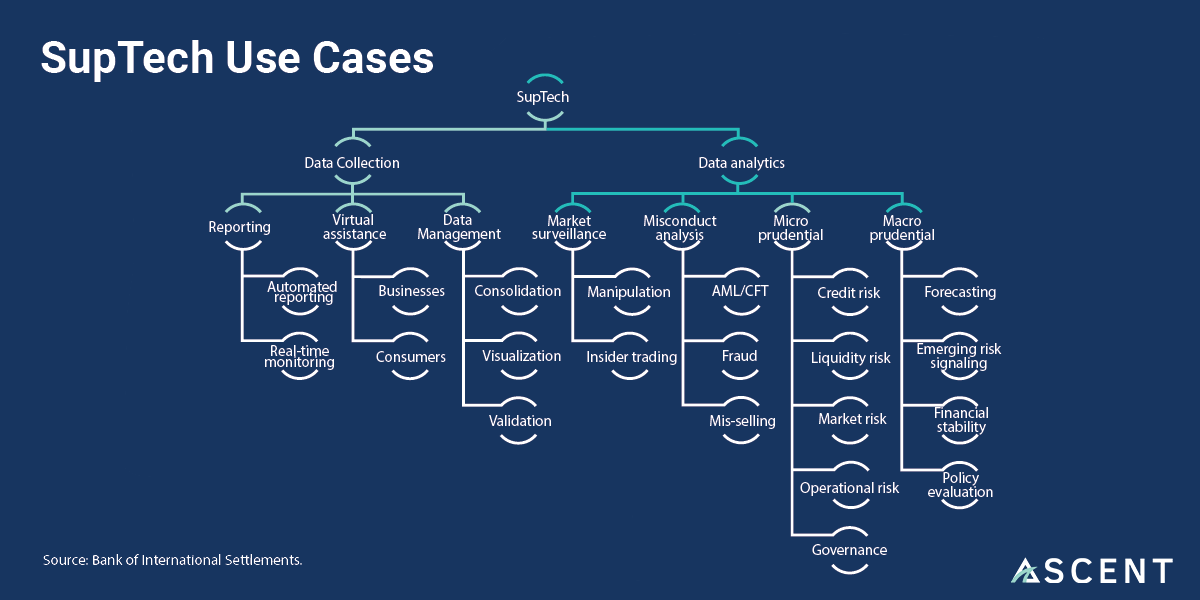

This is the dream of SupTech, which is quickly becoming a reality. It is built around two aspects of financial supervision: data collection and data analytics.

READ MORE: What the Tech? Machine Learning Explained

Streamlining Data Collection

Historically, data collection for regulatory reporting has focused on using standardized reporting templates — a holdover from the days of paper-based reporting. While these templates help organize data uniformly, they can be costly to update, making it difficult to keep them current with the fast-paced change occurring across financial services.

Additionally, these templates can be extremely inefficient. Because of how heavily regulated financial services is, one transaction may have to be reported to multiple regulatory bodies, meaning multiple reports have to be completed and submitted by financial institutions and then also ingested and analyzed by regulatory bodies, creating inefficiencies for all parties involved.

As regulations have increased, regulators have been forced to step up the frequency and granularity of the data they ingest. It’s quickly become clear that standardized reporting templates aren’t up to the challenge.

SupTech providers are already creating solutions. One, pioneered by the Austrian regulator OeNB, is AuRep (Austrian Reporting Service GmbH) — a reporting platform that can be used by both supervised entities and supervisors. It allows banks and other financial firms to input their data into the system to seamlessly send it to the OeNB.

This allows for a much higher level of integration between parties, improving the speed at which regulators can receive data and the granularity and accuracy of that data. But this methodology — known as data-input — is just one way to improve on the standardized template process.

Other SupTech solutions are investigating data-pull processes, where data is sourced directly from an institutions operational system and then pulled into the supervisory platform. Alternatively, a real-time access approach would let supervisors “see” the data at will rather than only during reporting periods, allowing them to monitor and interact with data without a time delay.

Data-input, data-pull, and real-time access approaches would all rely on APIs, short for application program interfaces — a technology making waves in other sectors of financial services as well.

READ MORE: Open Banking: What It Is, Why It Matters, and How RegTech Can Help

Overhauling Data Analytics

Once regulators have collected these massive pools of raw, unformatted data, the next question is what do they do with it. While it can be a challenge for humans to sift through and make sense of large data sets like these, this is where big data tools like AI and machine learning really begin to shine.

Here are just a few of the ways SupTech solutions are tackling data analytics:

- Supervisors can use machine learning tools to create a “risk score” for supervised entities. FINTRAC, the Financial Transactions and Reports Analysis Centre of Canada, has created one such score, evaluating the risk factors related to an institution’s profile, compliance history, reporting behavior, and more.

- Supervisors can also use network analysis to assess an entity’s exposure to money laundering risk. DNB (De Nederlandsche Bank), for example, analyzes transactional data in order to detect whether related entities are sending funds to the same party through different financial institutions.

- A number of regulators, including ASIC (Australian Securities and Investments Commission), the Bank of Mexico, and the FCA (Financial Conduct Authority), are leveraging natural language processing technologies to audit the promotional materials, prospectuses, and financial advice documents that are produced by financial institutions.

Beyond Data: Other SupTech Solutions

Data collection and analytics aren’t the only domains of SupTech solutions.

The FCA and BSP (Bangko Sentral ng Pilipinas) in the Philippines are both working on implementing chatbots to interact with supervised entities more efficiently. The chatbots would be able to answer questions for the supervised entities and also provide regulators with a wealth of information about what kinds of concerns supervised entities had.

The FCA is also looking into machine-readable regulations, what it is calling Digital Regulatory Reporting. In a tech sprint, the FCA developed a trial system that translated reporting rules into machine-readable language — non-English text, standardized so it can automatically be read by a computer system. Once translated, machines could then process these rules to compare them against a firm’s policies and procedures.

This and other efforts acknowledge the heavy burden of regulatory change management that’s plaguing financial institutions — and the ability of technology to help alleviate this process.

The Future of SupTech

SupTech is undeniably still in its early days. In recent research conducted by the Bank of International Settlements, only half of the participating regulators surveyed had or were developing SupTech strategies. And, of those strategies, less than a third were operational, with most still being in the experimental or developmental stages.

As SupTech advances, it will undoubtedly find new ways to make the work of regulators more accurate and efficient, but it will have serious questions to consider as well.

For example, by interconnecting regulators and supervised entities, will SupTech create new avenues for cyberattacks? And if supervisory technologies make a mistake, what will the cascading effect of this be?

Even more importantly, how much automation is the right amount for regulators? When implementing RegTech solutions, many financial firms have found the solutions work best when augmenting the work of Risk and Compliance teams, not replace it. It is likely that, in work as complex as that carried out by supervisory agencies, the same will be true for SupTech solutions. It will take patience and practice, though, to find that precise balance.

What is undeniable is that the processes of supervisors are ripe for digital disruption, much as those of Risk and Compliance teams were. It will be exciting to see how SupTech solutions add value to regulatory agencies in the years to come — and how they change the regulatory landscape in the process.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

Enjoy this article? Subscribe to receive helpful content designed to help you win at compliance.