The regulatory lifecycle is complex, dynamic, and a mission-critical part of your compliance operations. Every day, you face a tidal wave of new content – news, guidance, speeches, enforcement actions, and rule changes – from regulators that need to be efficiently and effectively shared, analyzed, and operationalized. From getting the right content to the right people to stay ahead of governance trends, to operating with obligation confidence and risk transparency, to ensuring accurate and traceable change management processes, it’s a never-ending process of content capture, analysis, and collaboration.

Effectively managing your regulatory lifecycle is a challenging endeavor, and financial institutions are constantly looking for ways to work smarter and faster using new technology. Ascent’s ebook “Taking Control of Your Regulatory Lifecycle” provides a comprehensive overview of how AI-powered automation can revolutionize your information sharing and compliance operations.

In addition, we’ve developed a quick and easy regulatory lifecycle management assessment survey to help you see where you’re hitting the mark, and where automation may help you decrease risk, eliminate bottlenecks, and work more efficiently.

Understanding the regulatory lifecycle

The regulatory lifecycle is a holistic, enterprise-wide series of interconnected teams, processes, and standards that must come together to ensure a high-performing corporate compliance posture.

- Precisely defining all the regulators that govern your business operations and jurisdictions and making sure you have access to all the content they publish.

- Clearly understanding corporate obligations, how they map to regulator rules, and with confidence in their accuracy and quality.

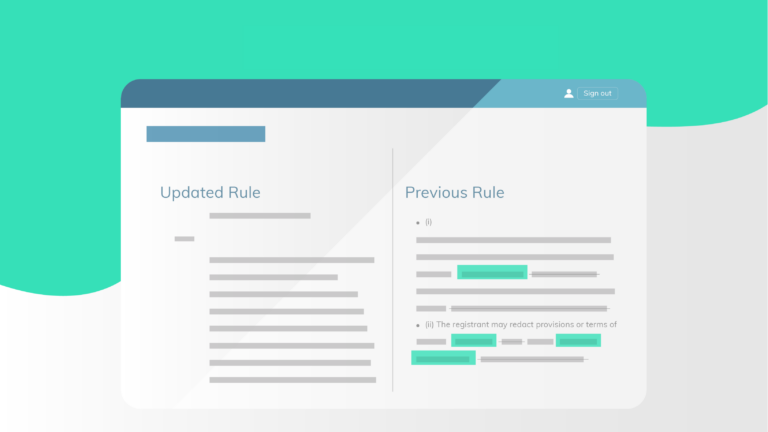

- Effectively conducting a change management process that quickly and accurately captures regulatory changes, identifies impacts to your business, and tracks update processes.

- Easily capturing end-to-end traceability across your obligations, policies and controls, with reporting and oversight capabilities for all levels of the organization.

- Proactively promoting internal and external audit-readiness without fire drills and reactionary efforts to demonstrate command and control of your compliance operations.

Today, many financial services firms manage their regulatory lifecycle as a series of disconnected and manual processes, leading to inefficiency, hidden risk gaps, and a lack of enterprise oversight. Not by choice, but rather, out of necessity.

Thankfully, digital transformation is rapidly changing all that.

High performing firms are rapidly embracing AI-powered automation like the Ascent Regulatory Lifecycle Management Platform in an effort to reduce risk, unlock efficiency, reduce operating costs, and improve agility. Our Platform, which includes next generation horizon scanning tools and revolutionary AI-powered change management capabilities, is designed to empower compliance, risk, legal and audit teams to:

- Know everything they need to know

- Respond to changes quickly and confidently

- Harness automation to power high-performing operations

- Scale regulatory lifecycle management across the enterprise

Ascent’s ebook, “Take Control of Your Regulatory Lifecycle” provides more details on how we help you eliminate risk, work more productively, and reduce costs.

Lastly, spend a few minutes assessing your regulatory lifecycle management processes to see how you rate, and how automation can be a game changer for your business. Or, Contact Ascent to learn more.[/vc_column_text][/vc_column][/vc_row]