The rise of digital currency (aka cryptocurrency) has caused regulators to grapple with how to fit it under existing money transmission laws.

Today, FinTechs and issuers of digital currency also find money transmission laws to be confusing and disjointed across state and federal jurisdictions. This lack of clarity makes it difficult for financial firms to manage the risk around their digital asset product and service offerings

In this article, we answer key questions about money transmission laws and share how business leaders can get a better view of their risk exposure as regulation changes.

Overview

- What is money transmission?

- Who needs to comply with FinCEN?

- Federal vs. state regulation

- How money transmission laws affect your risk exposure

- Identifying your money transmission requirements with Ascent

—

What is money transmission and how is it changing?

Money transmission is the act of receiving currency (or its equivalent) from one party, only to transfer it to another party. In the exact words of the Financial Crimes Enforcement Network (FinCEN), money transmission is:

“The acceptance of currency, funds, or other value that substitutes for currency from one person and the transmission of currency, funds, or other value that substitutes for currency to another location or person by any means.”

Over time, the application of this definition has evolved to account for the new reality of digital transfers of value FinCEN added the section about “other value” in an effort to bring the exchange of newly adopted “currencies” such as Bitcoin into its purview.

What firms need to comply with FinCEN requirements?

Today, firms that conduct money transmission activities are considered to be money services businesses (MSBs) under the Federal Bank Secrecy Act (BSA). FinTechs that are money transmitters must obtain state licenses, and are subject both to regulation by the states issuing the licenses and to anti-money laundering (AML) rules administered by FinCEN. For FinTechs that provide cryptocurrency transmission services, this means that they may need to provide transparency into their activity required by state money transmission and AML rules, even if the activity is otherwise “untraceable”.

How is it regarded under federal law vs. state law?

Aside from where FinTechs and digital currencies fit into the picture, money transmission laws are notoriously disjointed across federal and state jurisdictions. Here’s an overview of each.

Federal regulation around money transmission primarily focuses on preventing money laundering activity. FinCEN enforces the BSA, a federal act which requires institutions to establish and administer effective controls to prevent money laundering. Firms that transmit cryptocurrency t must comply with the BSA requirements, even when state-level money transmission laws don’t apply.

The other federal regulator that focuses on money transmission activities, including cryptocurrency transactions, is the Consumer Financial Protection Bureau (CFPB), part of the U.S. Department of Treasury. For the CFPB, money transmission is largely a consumer protection matter. The agency determined that institutions sending money transmission on behalf of consumers come within its rules, and outlined requirements for disclosures and error resolution procedures.

State regulations governing money transmission activities require Fintechs and other non-bank money transmitters to be licensed by the state.Today, 49 states have unique regulatory frameworks for money transmitters. Given the regulatory variation state by state, some lawmakers have attempted to harmonize their frameworks with those from other states. This harmonization is known as the Uniform Money Services Act (USMA). As of today, the USMA has been adopted by 12 states and territories. More recently, at least 23 states have joined together to streamline multi-state money transmitter licensing and supervision under what is known as the Vision 2020 initiative.

How do these laws impact firms’ risk exposure today?

Since money transmission regulation differs state by state and between the state and federal level, it presents a confusing environment for financial organizations to navigate. Many lawmakers and regulatory agencies are debating whether the current regulatory framework for money transmission laws is needlessly burdensome and whether it’s possible for firms to effectively safeguard against risk given the divergence in requirements.

This debate has become even more complicated in recent months as FinTech lenders and payment processors have become more popular with consumers. Regulators perceive these services as a potential breeding ground for financial misconduct as the vendor space has become increasingly crowded, and because of the challenges of differentiating between an illegitimate vendor and a legitimate one. To avoid any regulatory scrutiny (real or perceived), some financial institutions have limited their services and offerings, which has ultimately hampered revenue streams and constrained consumers’ options.

Identify your unique money transmission obligations

No matter what happens next, you need to know what your regulatory requirements are and how they apply throughout your business. With Ascent, you can quickly and accurately determine which money transmission requirements uniquely apply to your business.

Map your obligations

When you get set up on Ascent, you provide some information about your business, including what type of financial firm you are, what products or services you offer, and what activities you engage in. If you engage in money transmission activities, Ascent captures that information upfront, then automatically identifies which money transmission obligations apply to your business. The result is a targeted obligations register that ensures you know exactly which rules you need to comply with. Your obligations then update automatically whenever relevant rules change, providing automatic impact analysis.

READ MORE: What are granular obligations and how do they reduce your risk?

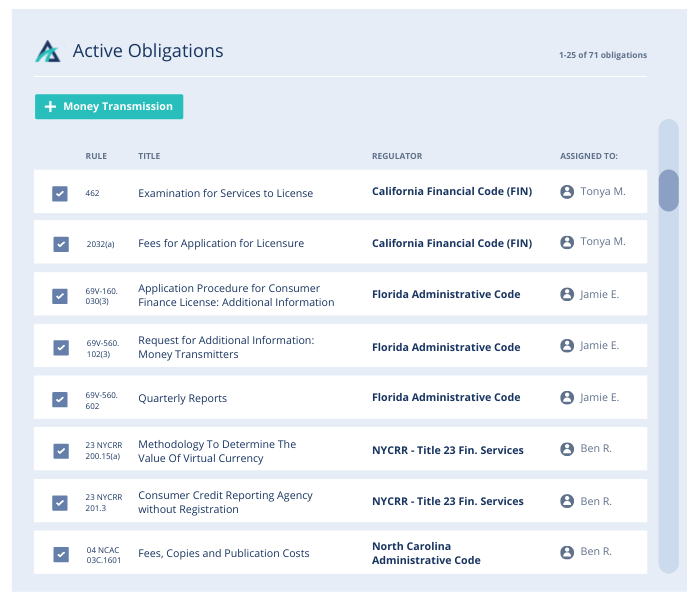

Here is an obligations register for an example U.S. payment processor that has to comply with a number of state regulators:

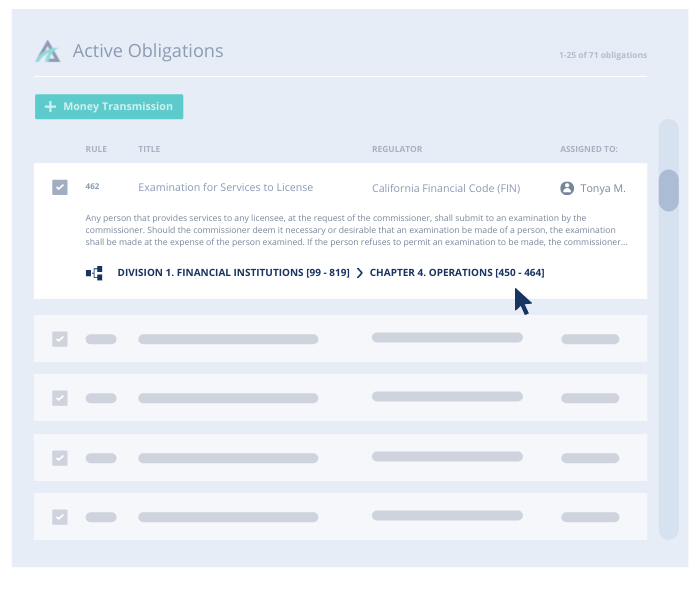

While these targeted, dynamic obligations are at the core of what makes Ascent unique, we also understand that most Risk and Compliance teams need the ability to dig into the regulatory texts in certain situations.

That’s why Ascent provides a breadcrumb trail with every obligation, enabling you to easily trace back to the regulatory rule or section the obligation came from. Full regulatory texts are housed on Ascent, allowing you to search regulations and conduct research all in one platform.

LEARN MORE: Traceability of Obligations in Ascent

Want to see how Ascent can help you gain a holistic view of your regulatory risk exposure? Contact us to request a demo or talk to our Sales team.

Subscribe below to get helpful articles and thought leadership that helps you stay at the forefront of compliance and technology.