Ascent empowers financial institutions to take control of their regulatory lifecycle, taming the tidal wave of regulator content, streamlining and automating change management processes, and providing end-to-end traceability across obligations, policies, and controls.

First, let’s identify what automating the regulatory lifecycle entails. To control the regulatory lifecycle, you must:

- Define your regulatory coverage by ensuring awareness of all relevant regulators, and receipt of news, guidance, enforcement actions, rules, and amendments from them.

- Establish a reliable source of compliance truth to ensure corporate obligations match regulator obligations, and that your obligations cascade into your policies and controls.

- Operate an accurate and efficient change management process to keep your obligations and regulatory content consistent and up to date.

- Ensure oversight across obligations, policies, and controls to enable internal compliance reporting, executive oversight, and external reporting to auditors.

One of the most challenging aspects of the regulatory lifecycle is change management. Many organizations continue to rely on manual processes, poring over spreadsheets and spending hours scanning regulatory texts to a) determine their relevance, b) identify the specific obligations or change in obligations a new rule requires, and c) identify the impact a change in obligation will have.

These are expensive, time-consuming, and mistake-prone processes. Human error inevitably creeps in, organizational silos can lead to erratic compliance across the organization, and when dealing with tens of thousands of regulatory changes each year (Ascent logged over 25,000 regulatory changes in 2023), manual processes are bound to miss or misinterpret things.

A case in point: A large global bank based in North America had a complex, outdated, and challenging obligations inventory. They relied on disconnected manual update processes that caused bottlenecks, including inaccurate interpretations, compounded by multiple, inconsistent revisions over time.

This created the risk of obligation gaps and undermined obligation, policy, and control confidence. In addition, their manual, multi-team regulatory change operations elevated the potential for regulatory scrutiny and organizational risk.

The bank then adopted AscentFocus to automate the regulatory lifecycle. AscentFocus first created an enterprise-wide obligations inventory, which was used to assess obligation integrity and identify issues. Risk assessments were conducted to identify and remediate gaps and fix obligations. During this process, AscentFocus identified and removed 5,000 duplicative obligations, and another 5,000 outdated or inapplicable ones. More importantly, over 1,500 obligation gaps (hidden risk) were found and remediated.

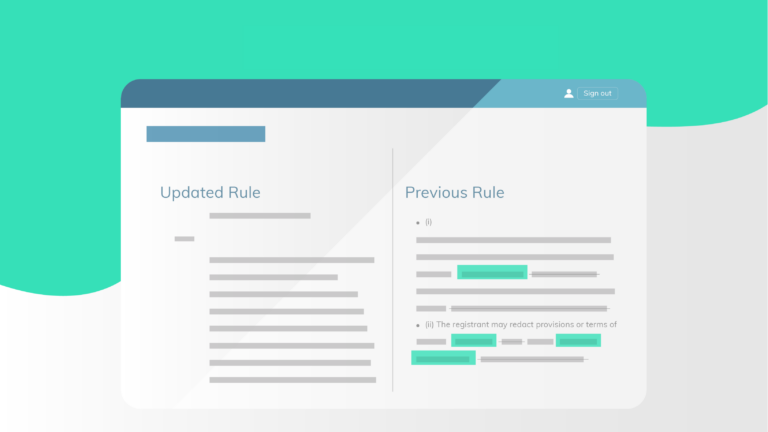

AscentFocus now powers change management routines, automatically identifying obligations and updating the obligations inventory, as well as identifying business impacts of regulatory change and ensuring obligations, policies and controls are compliant before implementation.

Another large global bank, this one based in Europe, questioned the effectiveness of their manual obligation management routines and risk impacts. They relied on manual regulatory data capture and change management processes that limited productivity and invited risk.

While they saw the time- and cost-savings that change management automation could deliver, they were hesitant to implement it. So diligently did they check and double-check their processes, they were confident of their accuracy, and feared that automation would actually decrease integrity.

The bank decided on a head-to-head test of their manual processes versus AscentFocus-powered automation. AscentFocus automatically created an obligations inventory, which was then compared with their traditional, manual approach for accuracy and speed.

Ascent delivered higher quality change management results, at a much faster rate, with full traceability. The bank saw a 50% increase in compliance team productivity with zero loss of integrity post-automation.

It is difficult to imagine manual processes besting Ascent’s patented, AI-based approach to regulatory lifecycle automation. The combination of machine learning, natural language processing, and human oversight eliminates costly manual processes while meeting or besting even the most rigorous manual reviews.

Automation of the regulatory lifecycle is an inevitability. Technology is making manual change management processes a thing of the past—like rotary phones. Those who maintain them will face a disadvantage through wasting hours, dollars, and resources.

To learn more about Ascent and our revolutionary solutions, Contact Us.