In the midst of these unprecedented times, one thing seems certain: one of the longest bull markets on record is now over.

We are in the midst of unprecedented times, filled with uncertainty. Markets are whipsawing daily, the health of the economy — both short- and long-term — is in serious question, and it is unclear what the next week will hold, let alone the next quarter.

We at Ascent won’t attempt to answer these unanswerable questions. Instead, we want to acknowledge a reality that daily seems to be more and more certain: One of the longest bull markets on record has now come to an end.

It will take time for governments to untangle the global uncertainties that grow more daunting by the day. In the meantime, businesses don’t have to feel paralyzed by inaction. Here are five ways to prepare for the new market environment.

READ ARTICLE: Creating Confidence in an Uncertain World

#1: Separate the Must-Haves from the Nice-to-Haves

The most immediate reaction to a tighter environment is to prioritize essential expenses and cut non-essential ones. This vital step sets the stage for the processes and procedures that follow.

You’ll likely be looking across your business for ways to reduce costs, but as you do so, it’s imperative you don’t undermine the fundamental and functional aspects of your business. This of course means protecting revenue-generating areas of your business, but it also means protecting the teams that protect your business.

Maintaining a stellar client-service reputation won’t matter if your business is overrun by cybercriminals — or if a lapse in compliance leads to a debilitating regulatory fine.

As you manage costs on a slimmer budget, insulate the areas of your business that make it functional so that they can help support the parts that make it successful.

#2: Focus on Efficiencies

Even after eliminating “non-essential” items, your list of expenses may still seem too long. Rather than cutting into the essentials, though, look for ways to improve efficiencies across your business.

Where is managerial oversight slowing down processes and creating unnecessary costs? How might you leverage hidden expertise within one department to help that of another? Perhaps buried in your IT department is a project-manager-certificate holder who can help organize the roll-out of your latest asset management strategy. Or maybe a junior associate has discovered how to streamline a burdensome administrative task but hasn’t had the opportunity to share it with other teams.

Now is the time to draw on the deep strengths of your teams so that they can empower your business to do more with less.

#3: Leverage Technology

Doing more with less is, as with many things, easier said than done. While it might be possible to ask some team members to wear another hat or share skills, departments likely won’t have the time and resources right now to wholly reimagine processes.

Instead, look for ways technology can help.

Talk with teams about which parts of their jobs are heavy on mundane, manual labor and could potentially use automated support. The recent explosion in machine learning capabilities has revolutionized how automation can support different job functions.

We at Ascent are of course strong believers in automation. By automating regulatory knowledge creation, we’ve seen firsthand how technology can reduce errors, drastically improve efficiencies, and free up internal experts to focus on more critical functions. Other automation tools can be similarly transformative for different departments.

#4: Prioritize Employee Well-Being

Employees are the pillars that hold a business up, and a bear market puts significant stress on those pillars. In their professional lives, they’ll likely be asked to take on more in a bear market, even if they already have full plates. And, at the same time, they’ll be bombarded with worrisome headlines adding stress to other areas of their life too.

So the mental and physical health of employees should be a top priority. Employees with a clear mind will undoubtedly be happier, less distracted, and — as a result — more productive.

Often, as firms look to buckle down on costs and increase efficiencies, the focus is too much on the number of hours worked and the output gained. What should also be considered is the potential expense of that work to employee well being.

Creating an environment that prioritizes employees and their health and empowers them with stimulating work will create a supportive atmosphere during a challenging time — and, ultimately, boost productivity in the process.

#5: Take advantage of the opportunity

Here’s a quote from Sun Tzu’s The Art of War that’s as cliche as it is true: “In the midst of chaos, there is also opportunity.”

Financial firms are known for reminding clients during downturns that it’s here the real money can be made — if one can bear the pain.

The same is true for businesses. Some of the most successful companies were started during a recession. By trimming excesses, improving internal procedures, empowering staff, and leveraging automation, you can position your business to take advantage of the potent opportunities emerging rather than being stuck in a paralyzed state of inaction.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

Most importantly, listen to your Risk and Compliance Teams.

Risk and Compliance professionals often serve as your crisis response team. They help companies implement new practices, create business continuity plans, and adapt to new environments.

In the midst of a bear market, their work becomes more vital than ever. A recession or global crisis doesn’t mean that the regulatory wheels stop turning. On the contrary, regulators will still be publishing rule updates to keep up with the changing environment. And internal departments will likely be moving quickly to take advantage of opportunities in the marketplace. The last thing a business needs during uncertain times is increased risk.

As the critical functions of Compliance and Risk teams ramp up, automation can help reduce their workloads as much as possible.

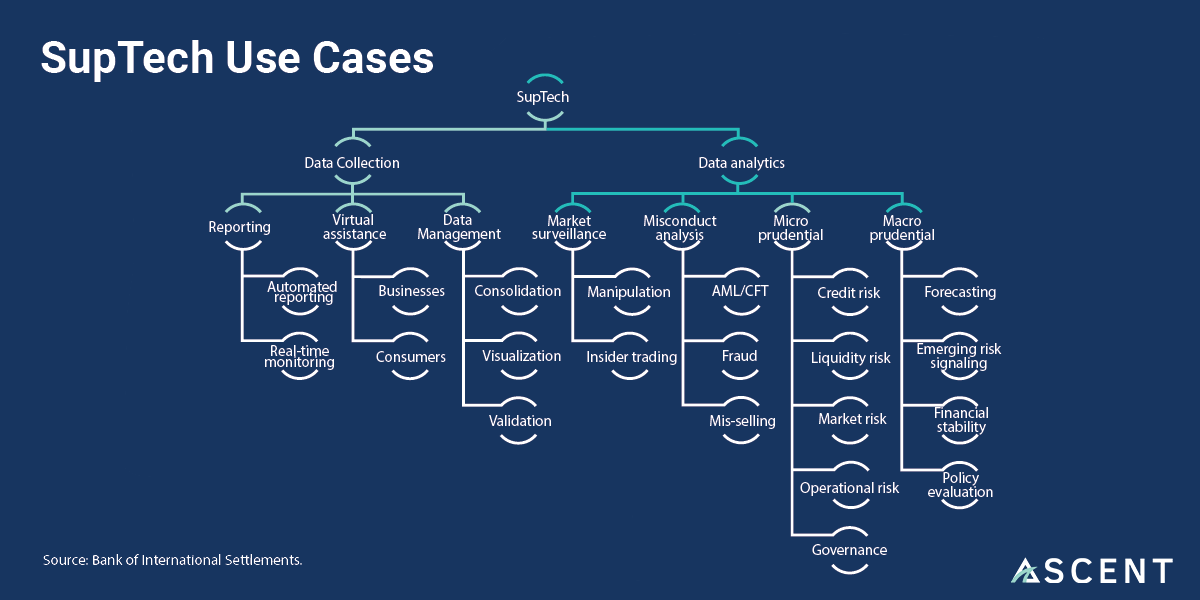

At Ascent, we leverage emerging technology to automate the routine aspects of regulatory compliance to reduce risks and costs. Tools like these help reduce time-consuming tasks like regulatory monitoring and channel those efforts into more vital parts of compliance.

At a time when it’s essential to eliminate as many roadblocks as possible, our solutions can help a firm feel empowered rather than constricted by the rule of law.

Enjoy this article? Subscribe to receive helpful content designed to help you win at compliance.