“The potential of this technology for the Bank and the financial services industry more broadly is exciting. By digitising parts of the regulatory change process, and the automation of continuously refreshing data we can improve the application of regulation, efficiency for our business as well as provide greater transparency with regulators. It’s been rewarding to collaborate with our RegTech and technology partners on a project that will have such a large, positive impact for our industry.” —Jasper Poos, Head of Governance and Assurance, Commonwealth Bank of Australia

Chicago and Armonk, NY: July 15, 2020 – Ascent, a provider of AI-based solutions that automate regulatory compliance processes, and IBM today announced a partnership to integrate their respective RegTech solutions in an effort to help banks and other financial institutions better manage their growing and ever-changing regulatory requirements.

Specifically, IBM is integrating Ascent’s regulatory knowledge platform with its IBM OpenPages with Watson solution. Clients will be able to feed their regulatory obligations and rule changes – which are automatically generated and updated by Ascent – into IBM OpenPages with Watson in order to better manage downstream compliance activities.

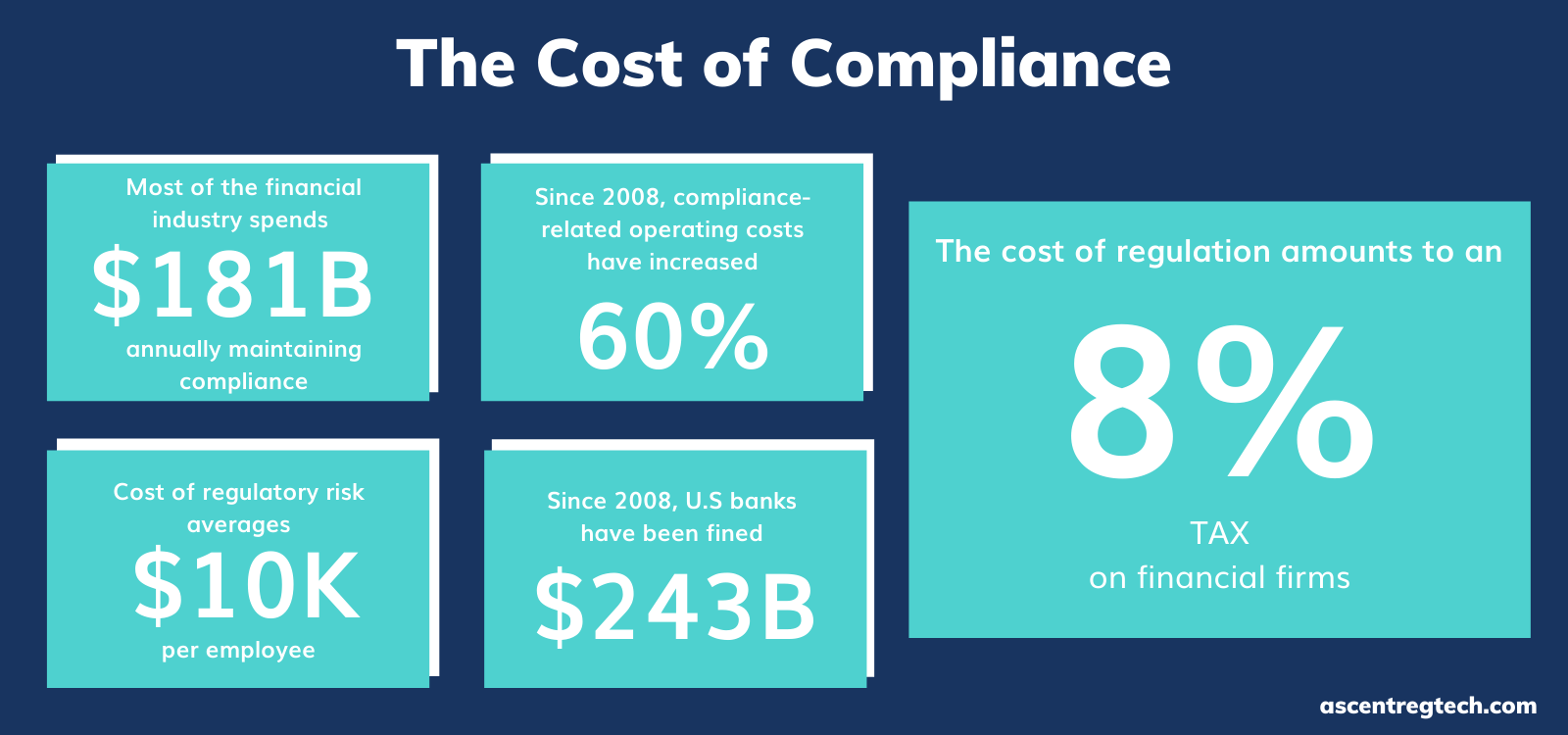

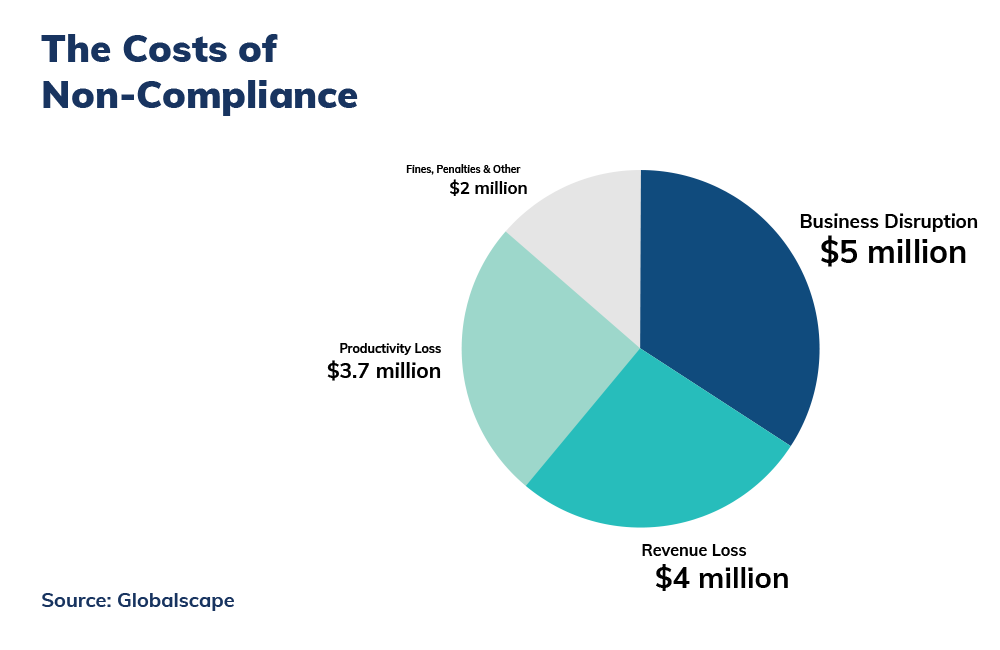

The integrated solution is designed to help regulated businesses keep better pace with today’s rapidly changing regulatory environment and help lower risk for potential fines and other supervisory actions. In addition, customers can benefit from the combined dynamic workflow capabilities and near real-time market intelligence by reducing the manual effort and time spent in transferring regulatory information between teams and disparate systems.

The IBM and Ascent partnership was the direct result of Ascent’s successful proof of concept engagement with the Commonwealth Bank of Australia (CBA), earlier this year, wherein IBM was also a key technology partner. The companies combined the Ascent platform with OpenPages with Watson which leveraged natural language processing and AI algorithms to identify and analyze more than 1.5 million paragraphs of regulatory text from the country’s Markets in Financial Instruments Directive II. The solution allowed CBA to quickly identify terms in the regulation that they needed to review and act upon – a process that would have taken days of manual scanning.

“The potential of this technology for the Bank and the financial services industry more broadly is exciting,” said Jasper Poos, Head of Governance and Assurance at Commonwealth Bank of Australia. “By digitising parts of the regulatory change process, and the automation of continuously refreshing data we can improve the application of regulation, efficiency for our business as well as provide greater transparency with regulators. It’s been rewarding to collaborate with our RegTech and technology partners on a project that will have such a large, positive impact for our industry.”

“AI for business is only as good as the ecosystem around it. And our collaboration with Ascent on the CBA solution is a great example of bringing innovative technologies together with purpose to help solve a growing challenge,” said David Marmer, Vice President, Offering Management, IBM RegTech. “Regulation can be complex, time consuming and costly. But with the application of AI and dynamically updated rules changes, companies are positioned to begin to operate and advance within those parameters quickly and easily.”

“We are pleased to launch this joint initiative with one of the world’s leading technology companies,” said Brian Clark, Ascent Founder & CEO. “Ascent is designed to work with OpenPages and other enterprise systems in a powerful and complementary way. Ascent’s ability to map obligations and regulatory changes targeted to the customer is a powerful workflow trigger for GRCs. We are excited about the implications it will have for our clients in financial services and look forward to helping them dramatically reduce regulatory risks and costs going forward.”

Ascent has been rapidly gaining momentum since its founding in 2015. Since its inception, Ascent has grown 100% YOY, secured $26.7M in funding, and expanded to 50 full-time employees.

###

About Ascent

Ascent was founded in 2015 to help financial services firms automate the most tedious and error-prone aspects of compliance. With customers from Tier 1 and Tier 2 banks and other financial firms around the world, Ascent provides Knowledge-as-a-Service (KaaS) as a groundbreaking new way to navigate the increasingly complex world of regulations quickly, efficiently, and most important of all, reliably. Learn more at www.ascentregtech.com.

About IBM OpenPages with Watson

For more information about the latest release of IBM OpenPages with Watson, version 8.2, check out the IBM webinar on June 23.

View this announcement on the IBM News Room.

Media Contact:

Patrick Phalon

MacMillan Communications

(917) 689-3438

patrick@macmillancom.com

Michael Zimmerman

IBM Media Relations

mrzimmerman@us.ibm.com